T. Mann Financial Client Portals

At T. Mann Financial, we pride ourselves on offering customized, tech-forward planning tools that empower our clients to engage with their financial plans in modern, personalized ways.

A visual snapshot for quick, high-level financial overviews.

A comprehensive planning platform for in-depth financial plans.

For retirement timing, Social Security, and withdrawal strategies.

A business plan creation and financial forecasting tool for business owners.

1 Page Plan

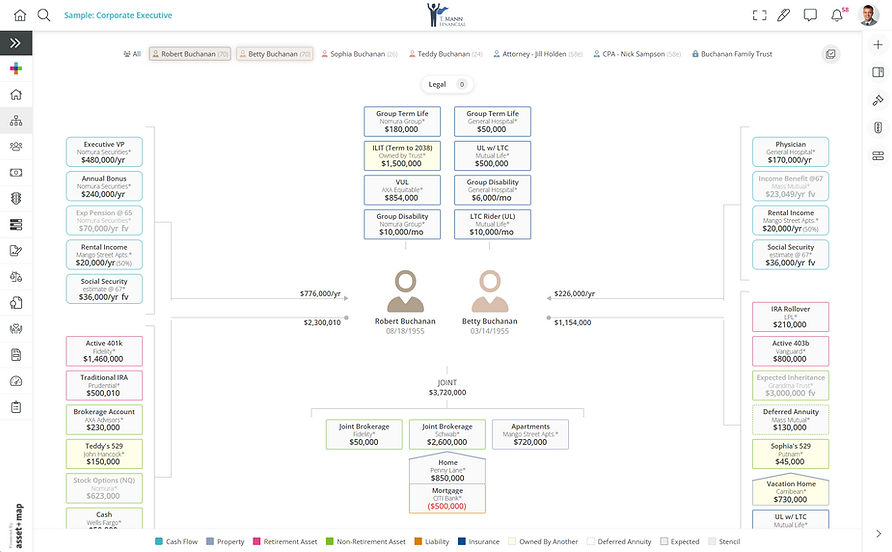

It can provide a digestible visual of your entire financial picture on one page, integrating assets, liabilities, insurance, and cash flows into an easy-to-understand map.

A one-page “Financial Map” of

Your Entire Household

This comprehensive view helps quickly spot gaps or opportunities in your financial plan, making it simple to identify areas that may need attention or improvement. Its intuitive diagrams make complex information easier to grasp, facilitating more meaningful, goal-focused conversations.

Key Features

Financial Signals

You can quickly identify red flags which lets us address issues proactively and discuss strategies to fill any gaps in your plan.

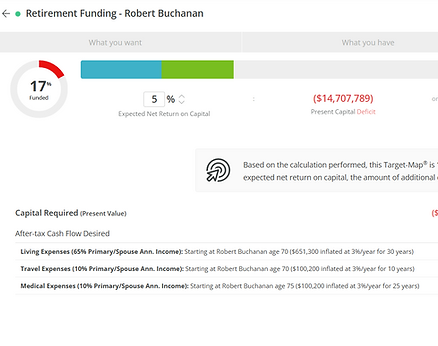

Goal Setting & Projections

Target your family's goals like retirement, college savings, long term care, or your own custom goals. The program will allow you to see where you are at with each goal and if course corrections need to be made.

Holistic Planning

A powerful, all-in-one financial planning tool that we use for creating detailed individual or family financial plans.It allows us to connect your goals (like retirement, education, or buying a home) with your actual investment accounts and data in real time, so we can monitor progress and adjust as needed

A Comprehensive Financial Plan

Our Financial Planning tool integrates powerful analytics, reporting, and planning tools into one user-friendly interface. It allows you to Track your investments and forecast your retirement and other goals, View consolidated accounts in one place, Make data-driven decisions with professional-grade insights, and Ensure security and privacy with bank-level encryption.

Key Features

Portfolio Tracking – Monitor your investments in real time with detailed performance reports and asset allocation insights.

Goal-Based Planning – Set, adjust, and track progress toward financial milestones such as retirement, education savings, and wealth accumulation.

Document Vault – Securely store and access important financial documents, including tax returns, estate plans, and investment reports.

Performance Reports – Generate comprehensive performance reports to review trends, returns, and allocations.

Risk Assessment – Evaluate your portfolio’s risk level and explore diversification strategies to align with your financial objectives.

Communication & Support – Easily connect with your financial advisor at T. Mann Financial for guidance, updates, and tailored financial strategies.

Retirement Income

A specialized tool focused on retirement income planning, it is particularly useful for managing the timing of retirement decisions and structuring your withdrawal strategy from investments. Unlike traditional static calculators, it continuously monitors economic and market conditions and uses a “guardrails” approach to adjust your plan over time.

.

Aims to Answer the 4 Big Questions

-

When should I start taking social security?

-

What can I spend in retirment?

-

What could cause me to make adjustments?

-

What should those adjustments look like?

Key Features

Dynamic Guardrails Strategy: Our tool employs risk-based guardrails to manage your withdrawal plan. That means instead of assuming a fixed withdrawal rate forever, the software sets upper and lower spending limits. If your portfolio performs better or worse than expected, the tool will signal whether you can increase your income (green light) or need to cut back a bit (red light) to stay on track. This approach aims to maximize your retirement lifestyle while protecting you from running out of money, adjusting as needed for market changes.

Customized “When to Adjust” Guidance: This tool gives targeted, personalized advice on when and how to adjust your retirement paycheck over time. For example, if there’s a market downturn, the tool might recommend pausing inflation raises on withdrawals, or if markets do well, it might suggest you can spend a little more. It also considers tax efficiency, helping decide which accounts to draw from first to minimize taxes. All of this happens within your plan’s guardrails, so adjustments are evidence-based, not guesswork.

Social Security Timing Optimizer: Our tool includes an advanced Social Security optimization module to help determine the optimal claiming age and strategy for your situation. It goes beyond the generic “wait until 70” rule by factoring in your health, family longevity, potential benefit cuts, and personal preferences. This means we can model scenarios like claiming at 65 vs. 70, or coordinating spousal benefits, and see the impact on your overall plan, helping to ensure your Social Security decision aligns with your retirement goals.

Ongoing Monitoring & Alerts: Once your plan is in place, the tool continuously monitors it. It will alert us if/when an adjustment is needed, kind of like a GPS giving “turn-by-turn” directions through retirement. If markets shift or your circumstances change, we’ll get an indication through the portal and can discuss the appropriate tweak (instead of waiting for an annual review to discover an issue). This proactive, tech-forward monitoring gives you confidence that your retirement income strategy remains sustainable over time.

Business Planning

A business planning and financial management tool that we provide to our entrepreneur and small-business owner clients. If you’re a business owner, this tool serves as an all-in-one platform to write your business plan, forecast financials, and track your company’s performance over time. It’s like having a business planning co-pilot, helping you clarify your strategy and monitor results in real time.

Key Features

Easy Business Plan Builder: This tool guides you through creating a professional business plan step-by-step. It offers customizable templates and prompts for each section (executive summary, marketing plan, financial projections, etc.), so you end up with a polished plan ready for lenders or investors. Over 500 sample plans are available for inspiration. The interface is very user-friendly, no MBA required! This reflects our tech-forward commitment to make planning approachable.

Financial Forecasting & Scenarios: The software includes robust financial forecasting tools. You can build budgets, revenue forecasts, and “what-if” scenarios (e.g. What if sales grow 10% more? or What if I hire two more employees next year?). These forecasts are linked to your plan and can be updated anytime. The tool even lets us create multiple scenario versions within one company file for comparison. This means you can see best-case, base-case, and worst-case projections for your business and be prepared for each.

Real-Time Performance Dashboard: The tool doesn’t stop at planning, it helps you manage your business. By syncing with your accounting data (e.g., QuickBooks or Xero), this tool provides a financial dashboard that tracks your actual results against your plan. You can log in and instantly see key metrics like revenue, expenses, cash flow, and profit, with charts comparing actual vs. forecast. This live dashboard makes it easy to spot trends or issues early (for example, if sales are off target this month) so we can adjust strategies proactively.

Collaboration & Coaching: With LivePlan, you and T. Mann Financial can collaborate in real time. The platform is cloud-based, so we can both access your plan and forecasts 24/7. We might help tweak your numbers, or you might update a goal, and changes are saved instantly. This shared access keeps us aligned and agile.

Need Assistance?

If you have any questions about accessing your account or navigating the portal, our team is here to help.

Contact T. Mann Financial for support:

-

Email Us- support@tmannfinancial.com

-

Call Us: 541-583-0093